Financial aid

There are numerous financial supports for families with children. Take advantage of these opportunities to ease your financial burden. Financial support from your employer is usually voluntary. You are legally entitled to state and country support. Both are united by the fact that you must actively take care of receiving the financial support yourself.

Employers can provide voluntary financial support for their employees. Financial stability helps the employee to concentrate on work without worrying about the family at the same time. Some ways of getting financial support from the employer are:

- Pro-rata payment of childcare costs for children who are not of school age

- Payment of recovery aid

- Subsidy for travel costs between home and place of work

There are several possibilities of financial support from the state. These are linked to certain conditions. Depending on your life situation, there are various state benefits, e.g:

- Child benefit / child allowance

- Basic Parental Benefit / Parental Benefit Plus

- Child supplement

- State education allowance

- Maternity allowance

- Alimony advance

- Care allowance

- Tax consideration of childcare costs

- Tax consideration of the relief amount for single parents

Child benefit is available for every child up to the age of 18 and under legally defined circumstances up to the age of 25 or, in the case of certain disabilities that occur before the age of 25, beyond the age of 25. Applications can be submitted via the relevant family funds or, for civil servants and employees in the public sector, via the employer's salary office or via special state family funds. The amount depends on the number of eligible children. Under certain circumstances, it is possible to receive an additional child allowance of up to € 170 for each child to be taken into account.

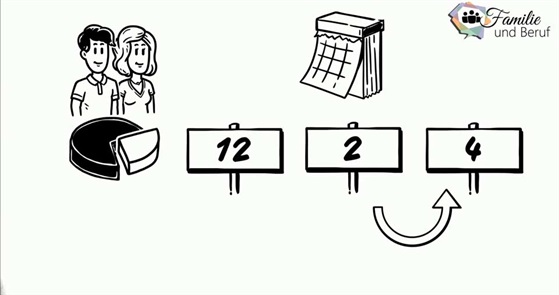

Parental allowance is intended to enable the parents to devote themselves fully to the child for a period of time. In principle, it can be paid for up to twelve months (freely divisible among the partners) and under certain conditions can be extended by two so-called partner months (under certain circumstances 4 further partner months with Parental AllowancePlus). It currently comprises 67% of your previous net salary per month - at least 300 euros (150 euros for ElterngeldPlus), but up to a maximum of 1,800 euros.

In cases where the income from gainful employment before birth was higher than 1,200 euros, the percentage drops from 67 percent by 0.1 percentage points for every 2 euros by which this income exceeds the amount of 1,200 euros to up to 65 percent.

In cases where the income from gainful employment before birth was less than 1 000 euro, the percentage increases from 67 per cent by 0.1 percentage points for every 2 euro by which this income is less than 1 000 euro to up to 100 per cent.

Parents who wish to share gainful employment and family work as partners receive support through the Parental AllowancePlus. This strengthens the compatibility of work and family life. The Parental AllowancePlus is aimed in particular at parents who wish to work part-time while receiving parental allowance. They receive twice as long parental allowance (up to a maximum of half the amount). Even if you don't have to, it is still an advantage in terms of good cooperation if you plan parental leave together with your employer.

Parents who have opted for longer childcare and do not claim a subsidised place in a day-care centre or state-subsidised childcare can also receive state child-raising benefit as support. The state child-raising allowance for the first child is 150 euros, for the second child 200 euros and from the third child 300 euros per month. The payments are reduced if the statutory income limits of the previous income are exceeded. These must be applied for at your responsible administrative district or city.

Mothers or fathers who care for the child alone may be entitled to maintenance payments. You can obtain free advice on how to claim your right to maintenance, if necessary with the help of the Youth Welfare Office. The prerequisite for this is that paternity is established and recognised. If you do not receive maintenance payments, you can apply for a maintenance advance. The advance on maintenance payments is then paid by the Youth Welfare Office. By a legislative reform to 01.07.2017 the requirement eligibility for maintenance advance was extended up to the completion of the 18th year of life of the entitled child, if the child does not receive achievements after the SGB II or the assistance need in the sense of the SGB II by the maintenance achievement can be avoided or the parent with whom the child lives, at least over an income at a value of 600 ? has.

Most state applications can be found on the websites of the competent authorities. But here you will also find many direct links to important forms and documents.

Questions and answers

How is the State education money regulated in Saxony?

The state child-raising allowance is intended as financial support for parents or single parents who wish to look after their children at home even when they are two or three years old. In the second year of life, however, this does not apply before the end of the entitlement to parental benefit. This can be, for example, in the context of a three-year parental leave. The state child-raising allowance is € 150 for the first child, € 200 for the second child and € 300 from the third child onwards. This additional payment depends in case of the first and second child on the income. The monthly net income limit is currently € 14,100 per year for single parents of children born before 01.01.2018 and € 17,100 per year for couples. For each child, this income limit is also increased by 3,140 euros each. From the third child onwards, the co-payment of state parental allowance is independent of income. The monthly net income limit is € 21,600 per year for single parents of children born after 01.01.2018 and € 24,600 per year for couples. For each child, this income limit is increased by 3,140 euros each, cf. § 3 Para. 2 Sächs. Landeserziehungsgeldgesetz in the version of 01.01.2019, Art. 9 of the Act of 14 December 2018 (SächsGVBl. p. 782).

Are there any tax benefits for parents?

Yes - these are usually effective through the tax return. Child allowances and child benefit are credited to the tax return. In addition, your solidarity surcharge and the church tax are reduced after the child has registered with the employer. This means that you must complete the attachment for each child in the tax return. With this, you apply for the deduction of childcare costs, school fees and also the training allowance for a child of full age in vocational training who lives abroad.

What is child benefit and when am I eligible to reference?

For families with a low income, the child supplement is provided. It must be applied for at the local family fund. Child supplement is only granted if there is no entitlement to ALG II. The basic requirements for the approval of the supplement are an existing child benefit entitlement. Furthermore, you must have a minimum income of up to €600 for single parents or €900 for couples. The maximum income may not exceed the limit according to ALG II.

Are there any financial support options that I can contact my employer about?

Yes, there are. One example is the childcare allowance. Detailed information can also be found in the Employers section of this platform.

What is family recreation?

Many federal states, including Saxony, offer a special form of financial support for family recreation. Low-income parents can apply for leave funding grants on request under certain conditions. The amount and granting of the grants are regulated individually in the Länder. In particular, recreational stays in Germany in family holiday institutions of the associations of free welfare and family associations as well as stays in institutions which are approved by the association to which the grant can be applied for are supported by the association to which the grant can be applied for. appropriately recognised. This applies to holiday apartments, youth hostels, family hotels and the like.

What are advance maintenance payments?

If the parent liable for alimony pays no or too little alimony, this is the prerequisite for the receipt of advance alimony payments. The advance alimony payments made will be reclaimed by the parent liable for alimony if he or she is able to pay them.

Where do I apply for housing allowance in Dresden?

You can apply for housing benefit in all citizen's offices, local offices and administrative offices in the villages. They will also give you general advice on housing allowances. You can also submit an application to the Social Welfare Office - Housing Allowance Department.

Checklist

Document

Application for child benefit - main application

Child benefit is paid to the legal guardian and depends on the number of children. The benefit is paid for children up to at least 18 years of age.

Bundesagentur für Arbeit - www.arbeitsagentur.de

Attachment (Child) to main application for child benefit

This document must also be submitted for each child in addition to the main application.

Bundesagentur für Arbeit - www.arbeitsagentur.de

Form for state child-raising benefit

Form to apply for Saxon State Education Allowance. Support for parents or single parents raising their children at home. This co-payment depends in case of the first and second child on the income.

https://amt24.Sachsen.de (Amt24 Government form service of the Federal State Saxony)

Application form for assumption of care costs

Application for payment of childcare costs. In general, the cost of childcare depends on your income, the number of children you have, the amount of childcare you receive and where you live.

amt24.Sachsen.de (Amt24 Government form service of the Federal State Saxony)

Application form for child supplement

Application form for child allowance. Financial support for families with low incomes.

Bundesagentur für Arbeit - www.arbeitsagentur.de

Application form for housing benefits

Tenants of residential space or owners of residential space can apply for a subsidy towards their housing expenses. The co-payment is income-dependent and only applies to people on low incomes.

To send to: Stadt Dresden, Abt. Wohngeld / Bildung und Teilhabe

amt24.Sachsen.de (Amt24 Government form service of the Federal State Saxony)

Helpful Links

About child benefit and child supplement - SMS Sachsen

Further information on child benefit can be found here. This state benefit is paid to parents of children up to the age of 18 or 25. If parents cannot afford child support for their child, a child benefit supplement can be paid additionally.

Financial benefit for family in Saxony with regard to family holiday - SMS Sachsen

Here you can find out more about the requirements for a subsidised family holiday, especially for large families, single parents and families with a low income or families with disabled relatives.

About state education benefit - SMS Sachsen

Here the Saxon Ministry for Social Affairs and Consumer Protection informs you about the state education allowance. This financial support is intended for parents or single parents who want to look after their children at home at the age of two or three. This can be for example in the context of a three-year parental leave. The co-payment for the first and second child depends on their income. It is only possible for parents with a low income. From the third child onwards, the co-payment is independent of income.

About Foundation »Help for Families, Mother and Child« – SMS Saxony

If you find yourself in an economic emergency that threatens your existence, contact this foundation. Here you will receive advice and help to improve your living conditions.

About tax relief - SMS Sachsen

Here you can find out about tax relief for families and single parents with children. You can also find out about regulations on training, childcare and child allowances.

Download page for child benefit and child benefit - federal employment agency

The most important leaflets, forms and applications of the family fund for download

Financial benefit for family in Saxony - amt24.sachsen.de

For families in Saxony, there are financial aids, which should offer you support.

About parental benefits - SMS Sachsen

Here you can find out in detail how mothers and fathers are financially supported with the parental allowance and how conditions and amounts behave.

About the Family Pass - SMS Sachsen

The family passport supports you financially. With this pass you can visit cultural institutions free of charge. You can find out who can get it here.